We can all agree that sales tax laws are very tricky.

If you own a brick-and-mortar store, collecting sales tax is an ordinary course of doing business.

Customers pay the sales tax required in your jurisdiction, and you submit payments to the government as necessary.

However, if you begin selling the same products online – to foreign customers – what are the tax rules?

Are customers charged the same rate online that they would pay in person?

Currently, the answer is not simple, yes, or no.

Join our qualified professional;

He is a member of Moores Rowland Asia Pacific, with over 30 offices in 11 Asian countries. Experts in his field will help you understand "What International Sellers Need to Know about Sales Tax."

KEY TAKEAWAY *

To be fully sales tax compliant, register for a sales tax permit where you have sales tax nexus, then file and remit sales tax due by each of your sales tax due dates.

OUR SPEAKERS;

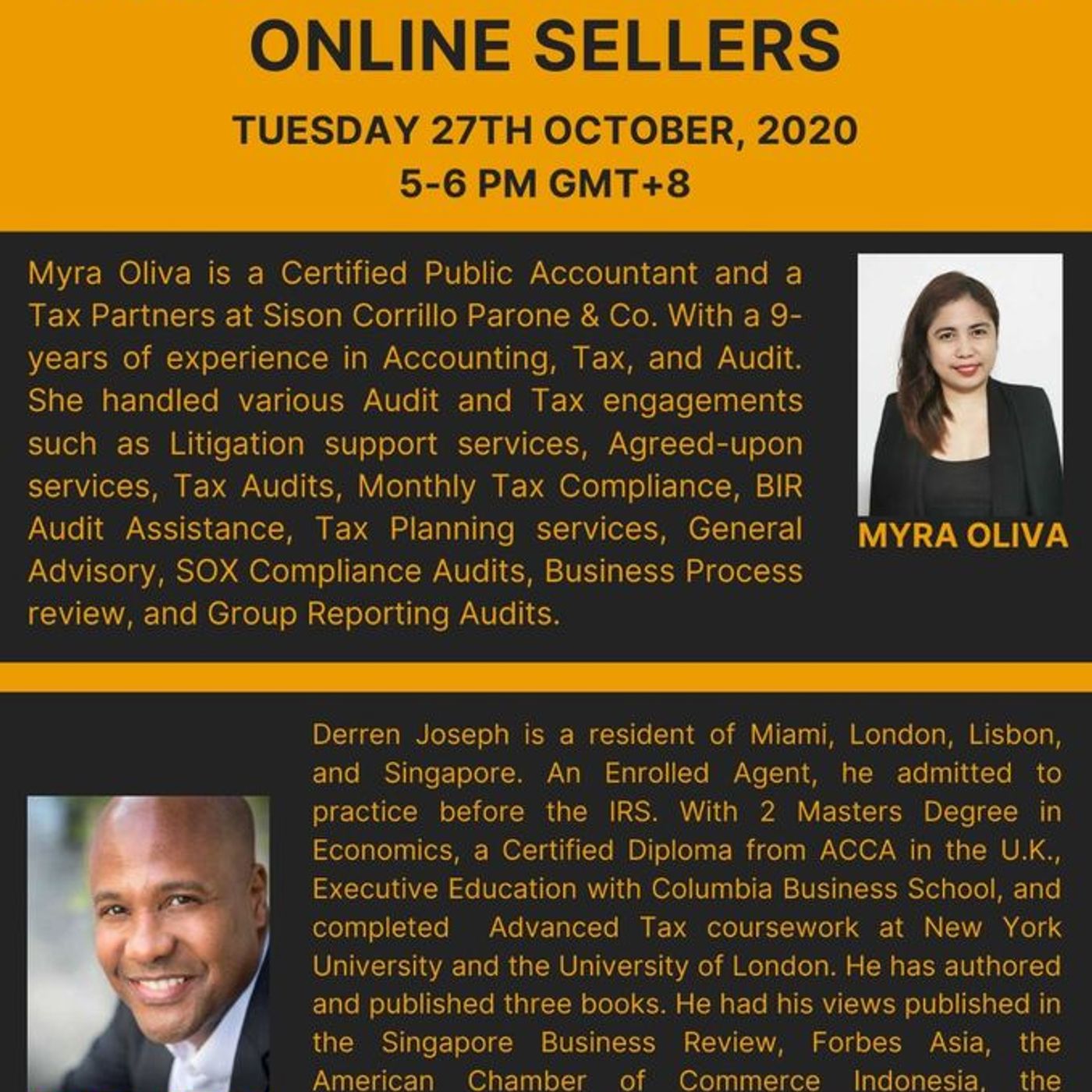

Myra Oliva

Myra Oliva is one of the tax partners at Sison Corillo Parone & Co.

She has over 9-years of practice experience in accounting, tax, and audit.

She has handled various audit and tax engagements, such as but not limited to Agreed-upon services, Litigation support services, Tax Audits, Monthly Tax Compliance, BIR Audit Assistance, Tax Planning services, General Advisory, SOX Compliance Audits, Business Process review, and group reporting audits.

She is a graduate of Polytechnic University of the Philippines with a Bachelor’s degree in BS Accountancy and is a Certified Public Accountant.

Derren Joseph

My name is Derren Joseph, and I am a part of a finance practice that works with entrepreneurs and ex-pats doing business internationally.

Buy our books - https://www.amazon.com/author/derrenj.

Join upcoming webinars - http://www.htj.tax/

Read our articles - http://www.htj.tax/.

Follow us on your favorite podcast platform - http://www.mooresrowland.tax/2020/06/.

Connect with me on LinkedIn -- http://uk.linkedin.com/pub/derren-jos.

If you own a brick-and-mortar store, collecting sales tax is an ordinary course of doing business.

Customers pay the sales tax required in your jurisdiction, and you submit payments to the government as necessary.

However, if you begin selling the same products online – to foreign customers – what are the tax rules?

Are customers charged the same rate online that they would pay in person?

Currently, the answer is not simple, yes, or no.

Join our qualified professional;

He is a member of Moores Rowland Asia Pacific, with over 30 offices in 11 Asian countries. Experts in his field will help you understand "What International Sellers Need to Know about Sales Tax."

KEY TAKEAWAY *

To be fully sales tax compliant, register for a sales tax permit where you have sales tax nexus, then file and remit sales tax due by each of your sales tax due dates.

OUR SPEAKERS;

Myra Oliva

Myra Oliva is one of the tax partners at Sison Corillo Parone & Co.

She has over 9-years of practice experience in accounting, tax, and audit.

She has handled various audit and tax engagements, such as but not limited to Agreed-upon services, Litigation support services, Tax Audits, Monthly Tax Compliance, BIR Audit Assistance, Tax Planning services, General Advisory, SOX Compliance Audits, Business Process review, and group reporting audits.

She is a graduate of Polytechnic University of the Philippines with a Bachelor’s degree in BS Accountancy and is a Certified Public Accountant.

Derren Joseph

My name is Derren Joseph, and I am a part of a finance practice that works with entrepreneurs and ex-pats doing business internationally.

Buy our books - https://www.amazon.com/author/derrenj.

Join upcoming webinars - http://www.htj.tax/

Read our articles - http://www.htj.tax/.

Follow us on your favorite podcast platform - http://www.mooresrowland.tax/2020/06/.

Connect with me on LinkedIn -- http://uk.linkedin.com/pub/derren-jos.

Listen On

Also Listen

-

[ Offshore Tax ] Options For Americans In Dubai Who Aren’t U.S. Tax Compliant.

- Updated daily, we help 6, 7 and 8 figure International Entrepreneurs, Expats, -

[ Offshore Tax ] Migrating To The US With L Or E Visas.

- Updated daily, we help 6, 7 and 8 figure International Entrepreneurs, Expats, -

[ Offshore Tax ] Can Dependents Of E2 Treaty Visa Holders Get SSNs?

- Updated daily, we help 6, 7 and 8 figure International Entrepreneurs, Expats, -

[ Offshore Tax ] Are Tax - Free States Really Worth It?

- Updated daily, we help 6, 7 and 8 figure International Entrepreneurs, Expats,